About RFND Investment and the first SLP token I knew

When I was reading Uptrennd, I came across a writing contest for $RFND. I originally did not plan to write anything as I did not know anything about it, but I read more and more and since I already read much, why not just write something myself.

What is $RFND?

If you followed from the beginning, you probably have a solid understanding, but if you are a newcomer like me, you probably wonder what kind of perks that this token than bring other than just being a token. There are two chronological order to understand what $RFND is.

Bitcoin Cash

You probably know that Bitcoin is the first cryptocurrency which is a currency that is open, decentralized, permissionless, and many other features powered by cryptographic technology. It is able to verify transactions and reach a consensus without a third party but through algorithm. Thus, the ownership of assets is returned to each holders unlike the money in the banks.

Each people are different and each people have different visions and thus, the development of Bitcoin can no longer be in a singular path. Vitalik wanted to implement smart contracts on Bitcoin but was regarded as a spam by most developers so he created Ethereum. Roger Ver and some developers wanted to focus Bitcoin as a medium of exchange and found it necessary to increase the block size where one of the reason is for faster transaction but many developers do not agree and it is better to leave Bitcoin originally as it is so Bitcoin Cash was born. Cutting off the story, we proceed to this article’s explanation that $RFND is related to Bitcoin Cash.

Simple Ledger Protocol

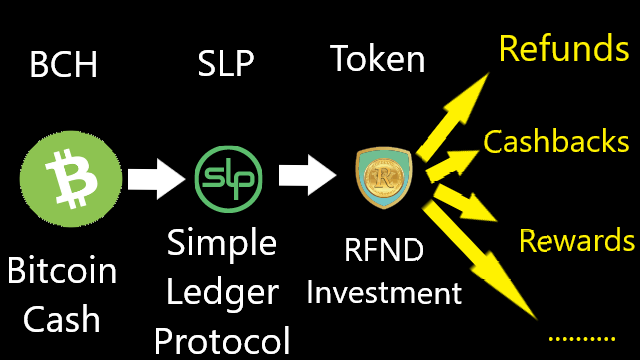

It is through $RFND that I first learned about simple ledger protocol (SLP). SLP is a protocol to issue tokens on Bitcoin Cash blockchain. From their FAQs, there is a question “Is SLP like Ethereum’s ERC-20, but for $BCH?” and the answer is “In many ways, yes.”. They are the same in where anyone can issue their own tokens with the difference that ERC-20 is following Ethereum’s vision while SLP is following Bitcoin Cash’s vision.

Finally, we can answer what $RFND really is. In substance it is a token issued with SLP. If you want to know its tokenomics such as its circulating supply, check through SLP’s explorer.

Intended Benefit of $RFND

I read the lightpaper and sorry to say it was very textbook for me. It was only on the founder’s (Jan Bouda’s) Youtube video, I finally get what $RFND is, at least from a newcomer’s perspective. RFND is an acronym of “refund” which is associated with other than refunds are cashbacks, rewards, discounts, etc. Psychologically when shopping, who does not love refunds eventhough there may not be much difference in the cost but refunds just makes most of us happy.

If check their Youtube channel, you can see that they even give $BCH cashbacks to $RFND purchasers. In their twitter, you can see that they give rewards and airdrops to loyal hodlers. Now we can finally understand what the lightpaper means. Other than what I wrote above, $RFND have a clear tokenomic schedule of 5.5 Decades Of Gradual Circulating Supply Issuance (DGCSI). Here is what is written “However, if there will be a strong bear market during that year, RFND Investment would start to slow down the circulating supply issuance speed or in some certain circumstances, we may even stop RFND issuance for some weeks or even use buy-back scheme.”, in other words in line in what they said on their website “refund” and “defends your funds”.

My Expectations

Their “refund” theme is attractive for me but the lightpaper lacks details of how they can deliver that refund. They can give $RFNDs as many as you want but holds no meaning unless they have value. They did give refunds in $BCH but how will they acquire more $BCH? They did mention of sharing their income from their digital products and eco friendly projects, but what are they? The alliances shows promise but as a new user, I do not know what they are, so at least provide some links. Oh wait! They are still early, so what I am demanding, they are working on it. Therefore, I will await for the good news.

Find Out More

Mirrors

- https://www.publish0x.com/0fajarpurnama0/about-rfnd-investment-and-the-first-slp-token-i-knew-xwqnrgm?a=4oeEw0Yb0B&tid=github

- https://0darkking0.blogspot.com/2020/12/about-rfnd-investment-and-first-slp.html

- https://0fajarpurnama0.medium.com/about-rfnd-investment-and-the-first-slp-token-i-knew-34811dfaa6fd

- https://0fajarpurnama0.github.io/cryptocurrency/2020/12/15/about-rfnd-investment-and-the-first-slp-token-i-knew

- https://hicc.cs.kumamoto-u.ac.jp/~fajar/cryptocurrency/about-rfnd-investment-and-the-first-slp-token-i-knew

- https://steemit.com/cryptocurrency/@fajar.purnama/about-rfnd-investment-and-the-first-slp-token-i-knew?r=fajar.purnama

- https://blurt.buzz/cryptocurrency/@fajar.purnama/about-rfnd-investment-and-the-first-slp-token-i-knew?referral=fajar.purnama

- https://leofinance.io/@fajar.purnama/about-rfnd-investment-and-the-first-slp-token-i-knew?ref=fajar.purnama

- https://0fajarpurnama0.wixsite.com/0fajarpurnama0/post/about-rfnd-investment-and-the-first-slp-token-i-knew

- http://0fajarpurnama0.weebly.com/blog/about-rfnd-investment-and-the-first-slp-token-i-knew

- https://0fajarpurnama0.cloudaccess.host/index.php/11-cryptocurrency/141-about-rfnd-investment-and-the-first-slp-token-i-knew

- https://read.cash/@FajarPurnama/about-rfnd-investment-and-the-first-slp-token-i-knew-6a09999f

- https://www.uptrennd.com/post-detail/about-rfnd-investment-and-the-first-slp-token-i-knew~ODMxMTIz

- https://www.floyx.com/article/0fajarpurnama0/about-rfnd-investment-and-the-first-slp-token-i-kn-0001b20931

- https://markethive.com/0fajarpurnama0/blog/aboutrfndinvestmentandthefirstslptokeniknew