Can DEXG Speculative AMM Minimize Price Manipulation and Distribute Ownerships?

Disclaimer

This article can be highly inacurate because this is only my understanding and my imagination based on:

- DEXG’s Publish0x blog post

- DEXG’s website

- DEXToken Protocol Whitepaper

- Flowchain’s Tokenized Hardware: The New Crypto Innovation

- Volatility Effect on the Adoption and Valuation of Tokenomics

- some other posts on Publish0x

which ultimately most of the screenshots are from the above sources. As an academic, I want to say that their publications are well written but I still find it hard to understand because it is not field and I have almost no experience in it. Still, I would like to direct this article to users where I address their problem and straight to the solution without explaining the method. Yes, most of us in public are only interested in how the product will be and care about what is inside the product later.

DEXToken Protocol is developed by The Flowchain Foundation which is an independent body that oversee the Flowchain open source project, a distributed ledger for the Internet of things (IOT). Currently, they are based in Singapore and have two branch in Shenzen for business development and Taipei for application development.

The Problem With Over Speculation

I only know two use case of volatility which are for uncorrelating an asset and for gambling. Other than that, volatility is generally a problem. A prime example of where volatility is problematic is for medium of exchanges. For example, a meal today costs 40 thousands Satoshis, tomorrow it costs 80 thousands Satoshis, and the next day costs 20 thousands Satoshis. Nobody wants to use something that is up and down as a medium of exchange, everybody wants to use something that is constant or goes up and only in that direction. Volatility discourages new users, new investors, and other newcomers which can slow down or even prevent development and adoption. There is even a publication that mathematically proves that volatility prevents adoption and vice versa where adoption can reduce volatility titled Volatility Effect on the Adoption and Valuation of Tokenomics.

Over speculation makes volatility much worse because speculators are overestimating a value and are willing to overspend. In the great depression of 1920s, people are willing to risk more than selling their assets and go into debts to invest in the stock market because they only see the stock market as always going up. Normally, when the winners take profit, the price drops and that is it. However when over speculation takes place, other people will also sell because they fear of the price going down. The sell pressure continues as they keep losing and cannot afford to lose anymore and cut their loses. Finally, the debt collector came, and the last of them are forced by the debt collectors to sell. In the end, over speculation causes the great depression and the actor behind the over speculation are greedy bankers and politicians.

Those Who Manipulates Price

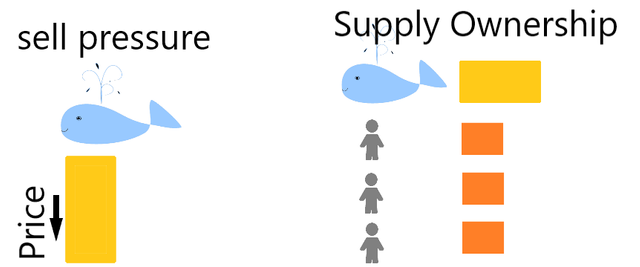

While in the current financial market there are greedy bankers and politicians, in the cryptocurrency market there are whales. How they can manipulate the price is related to the art of monopoly, those who controls the supply controls the price. For example, if Apple is the only smartphone provider, they can set the price as they wish. However, with the presence of Samsung, Microsoft, Lennovo, Xiomi, Huawei, and many other providers, Apple cannot price as they wish as there are other competitors willing to give better offers to the customers. Thus competetion is necessary for the customers’ prosperity. Greedy bankers and politicians and whales can manipulate the price as follow:

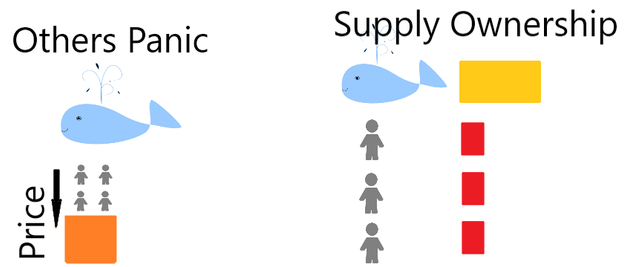

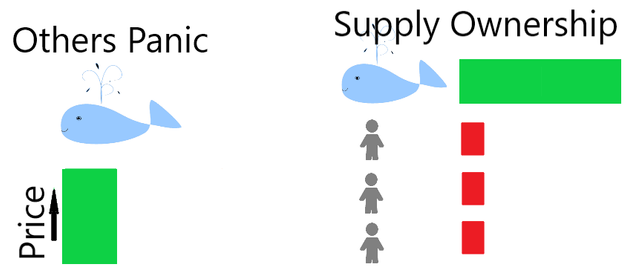

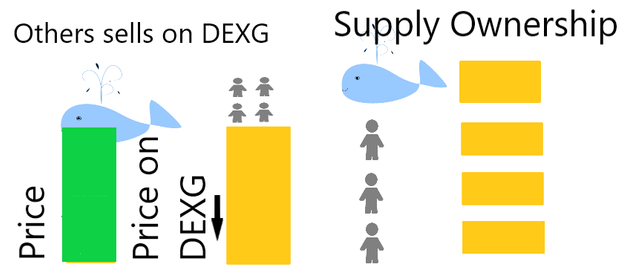

A whale causes a sell pressure.

Others sells out of fear.

Whale buys back at cheaper price and owns more of the supply.

Can Speculative AMM Discourage Whales?

While traditional order books determine the price purely on orders, Speculative AMM determine the price based on:

- total miners

- total transactions

- total wallet address

- aggregated transaction needs

- platform productivity

- circulating supply

and if you want to know what they are and why, you should read TOKENOMICS: DYNAMIC ADOPTION AND VALUATION.

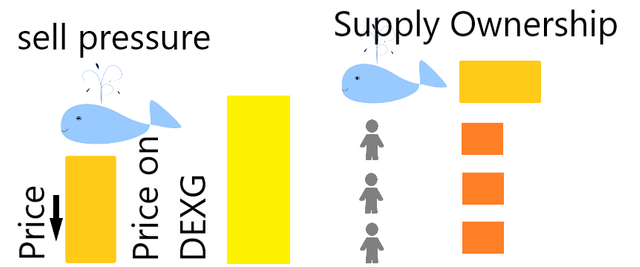

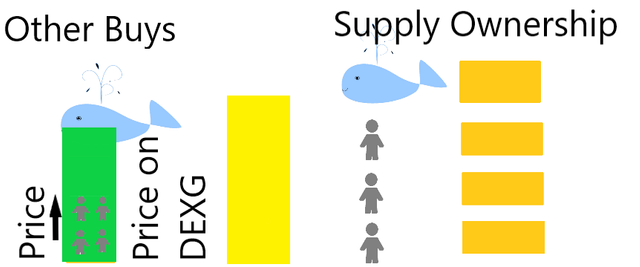

Therefore, whales should not be able to pressure the price on DEXG exchange as much as on regular exchanges supposing that liquidity is unlimited.

A whale causes a sell pressure. Speculative AMM senses a whale causing a sell pressure and does not drop the price as much on DEXG exchange.

Others see the price difference and begin to perform arbitrage trading where they buy whale sell order.

The arbitrage trader sells on DEXG exchange and repeats until both prices balances. Since the price is higher than the whale sell price, the whale is discouraged to buy back and the ownership of the supply is distributed to others.

DEXToken Governance (DEXG)

21 October 2020

- Token holders will profit from a portion of the exchange profit because there will be more arbitrage traders as I predict above.

- Token holders can stake and get more shares of the total supply.

- Token holders may participate in governance.

- Other utilities may come soon.

https://youtu.be/tKCceU8W-5U

If you want to participate in the Luna Staking Round, do the following:

- If you do not know how to use Ethereum DAPP, watch my previous video first.

- Buy Ethereum and Dextoken Governance and USDC.

- Go to 90% DEXG and 10% USDC Balancer.

- Connect your wallet.

- Setup proxy for first time.

- Approve DEXG and USDC.

- Add liquidity 90% DEXG and 10% USDC.

- Go to https://stake.dextoken.io.

- Connect your wallet.

- Navigate to the Deposit tab.

- Enter the amount of BPT you would like to deposit for the staking round.

- Approve the amount of BPT with the smart contract.

- Deposit the amount of tokens you have chosen for approval.

Mirrors

- https://www.publish0x.com/0fajarpurnama0/can-dexg-speculative-amm-minimize-price-manipulation-and-dis-xllrrww?a=4oeEw0Yb0B&tid=github

- https://0darkking0.blogspot.com/2020/10/can-dexg-speculative-amm-minimize-price.html

- https://medium.com/@0fajarpurnama0/can-dexg-speculative-amm-minimize-price-manipulation-and-distribute-ownerships-97c468d791d2

- https://0fajarpurnama0.github.io/cryptocurrency/2020/10/20/dexg-samm-flowchain

- https://hicc.cs.kumamoto-u.ac.jp/~fajar/cryptocurrency/dexg-samm-flowchain.html

- https://steemit.com/cryptocurrency/@fajar.purnama/can-dexg-speculative-amm-minimize-price-manipulation-and-distribute-ownerships?r=fajar.purnama

- https://hive.blog/cryptocurrency/@fajar.purnama/can-dexg-speculative-amm-minimize-price-manipulation-and-distribute-ownerships?r=fajar.purnama

- https://blurt.world/cryptocurrency/@fajar.purnama/can-dexg-speculative-amm-minimize-price-manipulation-and-distribute-ownerships?r=fajar.purnama

- https://0fajarpurnama0.wixsite.com/0fajarpurnama0/post/can-dexg-speculative-amm-minimize-price-manipulation-and-distribute-ownerships

- http://0fajarpurnama0.weebly.com/blog/can-dexg-speculative-amm-minimize-price-manipulation-and-distribute-ownerships

- https://0fajarpurnama0.cloudaccess.host/index.php/11-cryptocurrency/77-can-dexg-speculative-amm-minimize-price-manipulation-and-distribute-ownerships

- https://read.cash/@FajarPurnama/can-dexg-speculative-amm-minimize-price-manipulation-and-distribute-ownerships-edaafc5f

- https://www.uptrennd.com/post-detail/can-dexg-speculative-amm-minimize-price-manipulation-and-distribute-ownerships~NzgxMzQw