My End of Year 2020 Cryptocurrency Investment Report

I started learning about cryptocurrency around March 2019 just before Bitcoin rises to $5000. Like everyone else, I imagined those people buying Bitcoin at $1 less and it once reached $20000. These people became reach overnight. Bitcoin drew my attention but I was smart enough to know that $20000 is a bubble that will pop and when it finally dropped to $3000 was my chance to get in. It was my first time so it took me long to register to exchanges, tried only $100 and time ran out that it was after above $5000 that I made a decent investment.

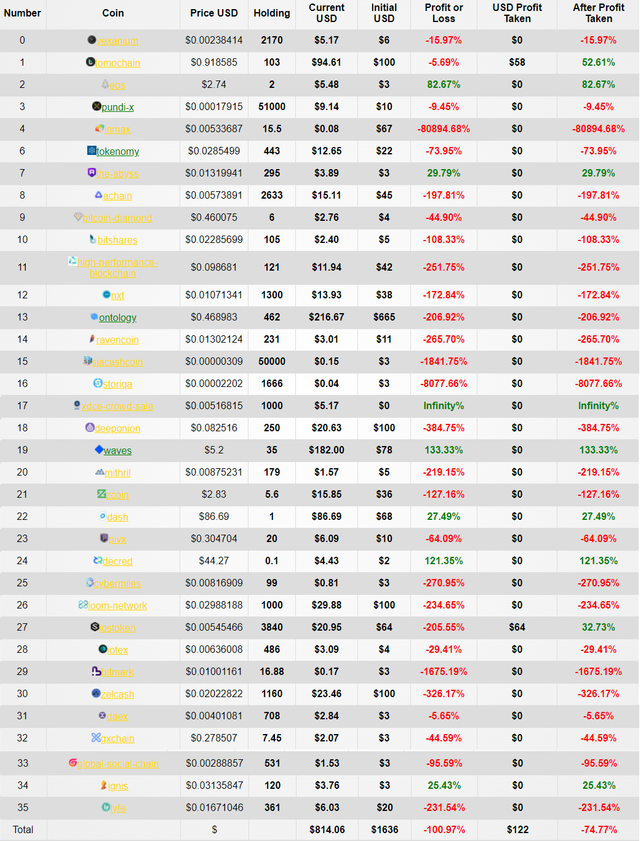

I sold most of my Bitcoin above $9000 and decided to try buying altcoins. The altcoins that I bought in 2019 are coins from Indodax and proof of stake (PoS) coins at that time. Back then, my mindset was still certificate of deposit (CD) where I want to put my savings to work by earning interest so PoS coins attracted me at that time. I did not realize back then that the interest does not matter, but what matters is buying at the bottom and hold until the bull market came while earning interest. Inflationary interest does not save anyone in the bear market. The PoS coins I bought are mostly from Binance, and Kucoin. I staked them in their native wallets, Honest Mining, and Cobo Wallet (input 089ZY6 for bonus if you are newly registered).

It was the bull market and whatever I bought became profitable less than a week. However, all my investment crumbles when the bear market came and that is when United States (US) regulator cracked into the crypto industry where only the cryptocurrencies that they approved are allowed to be sold in the US. I was still very green and did not knew the meaning at the time. I finally realized the severity when crypto exchanges started to exclude US citizens from their services. The most customers are from the US and when these customers are gone, ofcourse the price fell.

My worst loss that year was Ontology where I bought almost $700 and I was in profit of $200 in a month. I saw many flash surges and put my sell order high hoping to get lucky. What I did not realized was that it could fell drastically because my only price indicator was from Indodax and did not know that there were more price histories. Today, I am at lost of $600 in Ontology. The first time I became a victim of a seems to be a Ponzi Scheme is InMax where I really bought at the top as soon as it was listed and not a month have passed it drops by 100% and quickly after that my $67 became almost $0. It was released in 2018 and promised for a product including mobile app in 2019 but even now in 2021, no news and even the whitepaper roadmap stopped at 2019. Another significant loss was Deep Onion of $75 today. I did not think twice of spending $100 in it because I was a fan of The Onion Router (TOR) and their deep vault utility was interesting enough for me. The only mistake I made was that I bought in the bull market. So the lesson in 2019 is spot trade in the bull market but never invest in these times because the best time to invest is during the bear market where thare is blood on the street (Baron Rothschild, 18th century). I bought all these PoS coins in the bull market and even now it has not recovered such as Loom Network where I am down $60 and Zelcash where I am down $75.

Today, some of the coins recovered where three of them are PoS coins which are DASH up by $25, Tomochain up by $50, and https://www.coingecko.com/en/coins/waves up by $120. Still my 2019 portfolio is down by almost $700 today and imagine how painful it was during the bearmarket where it was down over $1000. Still, I am not sure whether I was actually down because I used the profit from investing in Bitcoin and put them here.

With this experience, I can confidently advice people to not invest more than they could afford eventhough I never made that mistake that year but imagine if I did and how devastated would I have been. Now, for beginners, always start small until you truly become experience where your prediction is often correct, know when to take profit and when to stop loss. Think about it, if you went big from the start and experienced a big loss like me, how will you rise back up again? On the other hand, if you start little, you lose little and you can try again tomorrow.

Wait, it is the bull market and everyone is getting rich by buying this and that. Isn’t this your chance to put $20000 and become a millionaire? If you are a beginner, I can warn you that that is fear of missing out (FOMO). Even if that decision can be right but how much is the probability that you can wrong? Remember, you are a beginner and as long as you are, what you do will always be gambling. Will you be the 10% who gets lucky and become a millionaire? or will you be the 90% losing traders and get wrecked? What happens if you are wrong now but the next opportunity for you to get rich came? If you used and lost everything in your first attempt, you will not be able to grab the next oportunity.

After my failed crypto investment in 2019, I finally did what I should have done and that is learn about cryptocurrency first. Finally I start learning of what Bitcoin is, why it was created, why do people take interest in it, and what other altcoins offered. Eventually, cryptocurrency led me to study other topics such as how currency where people believed to be absolutely money without second thought was created, the rest of the economy and more history. For example, can you answer how today’s cash is created? Most of us probably does not care until the system collapse where a meal today costs $10 and when the system collapse may cost $1000 just like what happened in Zimbabwe and Venezuela. It was at this point I felt receiving the true gem of crypto which for me are the knowledge, the innovations, and the crazy ideas. If you are interested, read what I have learned on my book.

I returned being a content creator writing blogs and making videos during my studies. I was more at technologies and utilities regarding to cryptos at this point where for example related to content creating I found anti censor blogs such as Steemit, Hive Blog, and Blurt Buzz, and convenient rewarding platforms such as Publish0x and read.cash. Publish0x not only rewards content creators but also readers for reading as well which became my secondary source of crypto information other than Youtube and odysee. It was here that I was introduced to decentralized finance (DeFi). Embarrassingly, was also my first time knowing about decentralized exchanges (DEX).

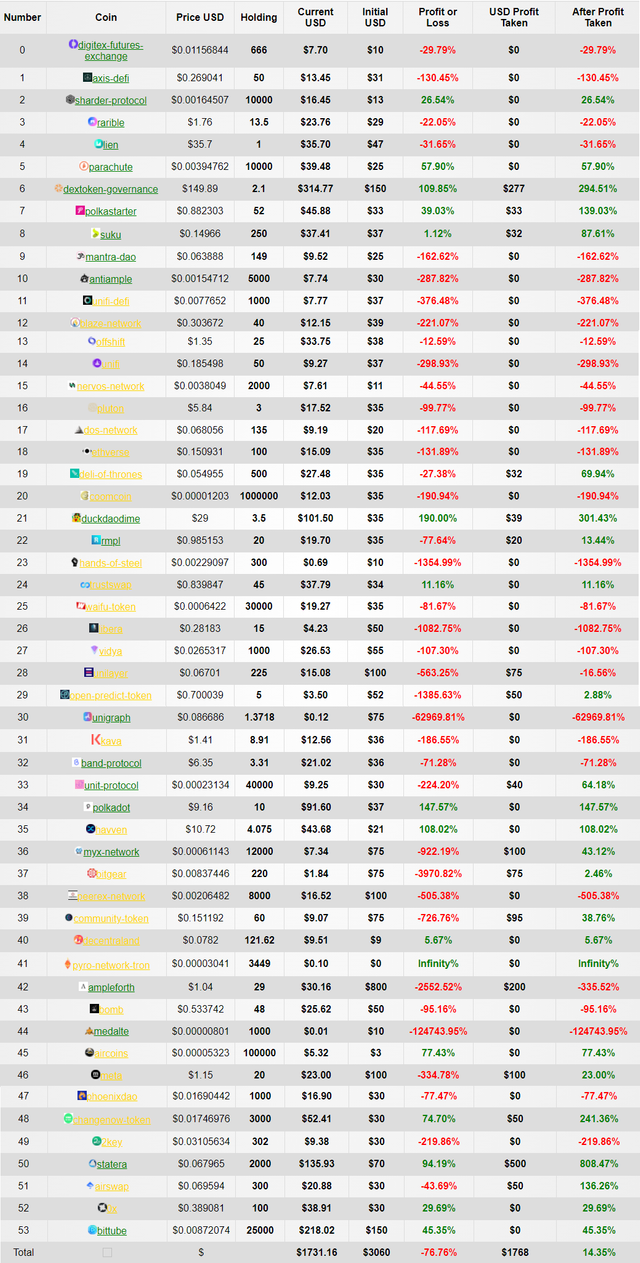

I saw DeFi as very early like went Bitcoin was $1 because few people knew about it and I was interested in investing again. However this time, I was protective to not invest more than $150 in each coin due to my loss lesson in 2019. I started learning how to use metamask and uniswap but unfortunately I was too late that tokens such as Trust Swap, BAND, Synthetix, and Aave already departed. For this kind of tokens, I looked for dips and invest no more than $40. Although most tokens have departed, I was able to catch the trains of Meta, ChangeNow, and AirSwap. Suprisingly, in this year, I got wrecked in a token more than Ontology last year which was Ampleforth where I lost $600. This time, the lost was influenced by a friend and would have avoided if it was not for that. I wrote a full story in form of meme if you are interested and also included my lesson of taking profit where taking profit saved me from MYX Network scam accusation effect and made me a strong holder of Statera where I took profit and lost nothing in the bear market and made it to the top where I took another profit of $500 that almost covers the Ampleforth loss and my luck ran out after that where I missed my chance of selling all of my Statera at the top for almost $1500. The second token that gave me large profit is DEXG where the mathematics impressed me eventhough I lack knowledge to understand most of them. I invested $150 but actually, I bought $100 and spent $50 to provide liquidity on balancer which providing liquidity below $1000 here is usually not profitable but miraculously, I earned 1.4 DEXG staking reward and hold it through the bear market and finally now that 1.4 DEXG is worth more than $250 in the beginning of this bull market. I sold it immediately so that I can let my remaining DEXG to provide liquidity in peace.

In conclusion, my 2020 portfolio survived last year. Unlike my 2019 porfolio with many losses, I learned that I should invest small if I am not fully sure about the cryptocurrency that I invested so that I can grab more opportunity in the future and always take profit by returning initial investment to have strong hand to hold. Heed my advice because investing and trading in Bitcoin is more dangerous than investing and trading in commodities and stocks and investing and trading altcoins can be more dangerous than investing and trading in Bitcoin.

Mirrors

- https://www.publish0x.com/0fajarpurnama0/my-end-of-year-2020-cryptocurrency-investment-report-xjmodgq?a=4oeEw0Yb0B&tid=github

- https://0darkking0.blogspot.com/2021/01/my-end-of-year-2020-cryptocurrency.html

- https://0fajarpurnama0.medium.com/my-end-of-year-2020-cryptocurrency-investment-report-9a77cc86a8b3

- https://0fajarpurnama0.github.io/cryptocurrency/2021/01/06/my-end-of-year-2020-crypto-investment-report

- https://hicc.cs.kumamoto-u.ac.jp/~fajar/cryptocurrency/my-end-of-year-2020-crypto-investment-report

- https://steemit.com/cryptocurrency/@fajar.purnama/my-end-of-year-2020-cryptocurrency-investment-report?r=fajar.purnama

- https://leofinance.io/@fajar.purnama/my-end-of-year-2020-cryptocurrency-investment-report?ref=fajar.purnama

- https://blurt.buzz/cryptocurrency/@fajar.purnama/my-end-of-year-2020-cryptocurrency-investment-report?referral=fajar.purnama

- https://0fajarpurnama0.wixsite.com/0fajarpurnama0/post/my-end-of-year-2020-cryptocurrency-investment-report

- http://0fajarpurnama0.weebly.com/blog/my-end-of-year-2020-cryptocurrency-investment-report

- https://0fajarpurnama0.cloudaccess.host/index.php/11-cryptocurrency/172-my-end-of-year-2020-cryptocurrency-investment-report

- https://read.cash/@FajarPurnama/my-end-of-year-2020-cryptocurrency-investment-report-dd0db086

- https://www.uptrennd.com/post-detail/my-end-of-year-2020-cryptocurrency-investment-report~ODQ1MzY2