Various Investments Through Financial Technology

I was once a walking bank. Unlike my peers in high school, I was never interested in spending my allowance for food which accumulates over $500 in the shelf of my room. I heard the term investing that money can make money and it was then I thought of how to make my money work for me. However, due to my busy life in college and did not want to burden my parents in paying the tuition fee, I saved my money in the banks and used them to pay my tuition fees, although in the end my parents stopped and to just let them pay for me. After I went abroad for graduate school with unconditional scholarship, I was finally independent and finally thought back of how to make money earn more money.

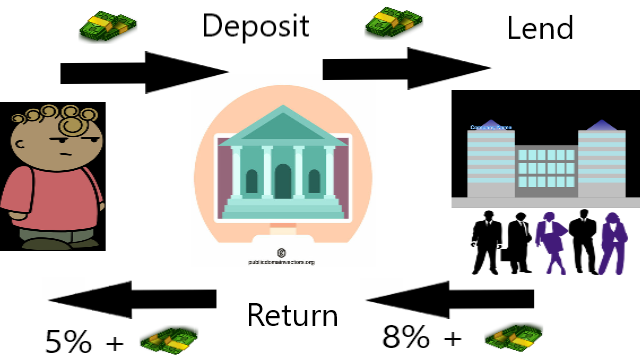

Certificate of Deposit

Short Description

Certificate of deposits were already on my mind since college but never proceeded because I was still under my parents. After becoming independent I went to the banks and asked about. It is as simple as I want a certificate of deposit and they will make it for us. A certificate of deposit is lending our money to the banks with us being paid in interest. I do not know much how they make money with our money but at least I know one of them that they lend our money to other figures and shared to us the profit they make.

Advantage

- Risk free, considered to be the safest investment which is why it is called savings instead where the amount of our deposit will never decrease and guaranteed to increase.

Disadvantage

- Offered the lowest interest compared to other investment products, less than 1% in developed countries and around 5% in developing countries.

- Long locked period ranging usually the choices are 1 month, 3 months, 6 months, 1 year, and 2 years.

- Minimum deposit of around $1000.

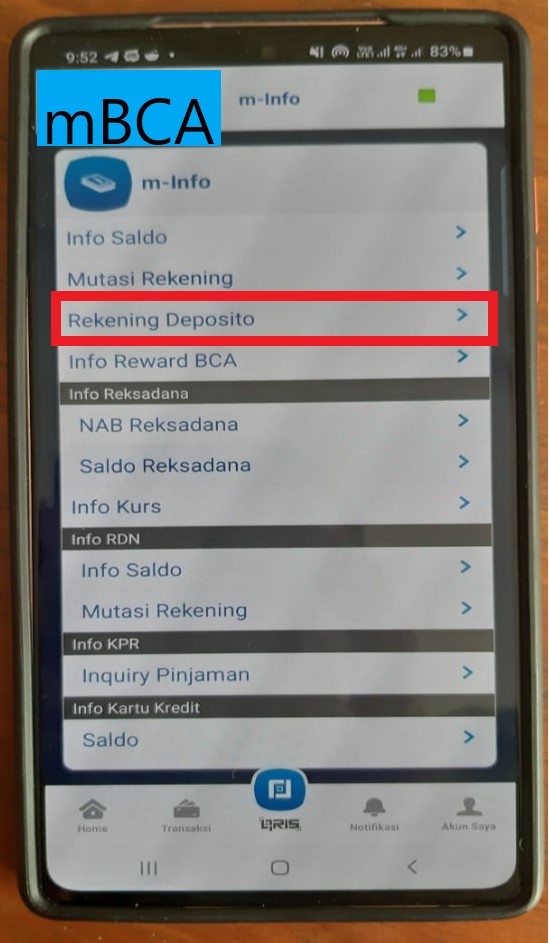

How To Invest

- Prepare identification card, bank book, and other necessary documents.

- Go to any bank.

- Open an Internet banking and/or mobile banking first.

- Ask them to make a certificate of deposit for you.

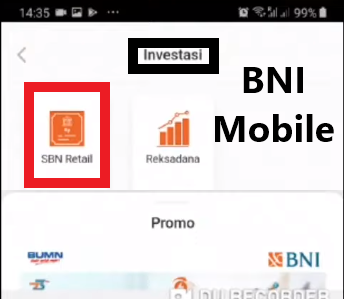

2. Government Bonds

Short Description

I do not know much about corporate bonds but I know about government bonds because they now actively offered all citizens to invest in them. They need funds to build the country and we can lend them where they will pay us back in higher amount. Sure that certificate of deposit are regulated but gorvernment bond have one more assurance which is backed by the government and the law.

Advantage

- Higher interest rate than certificate of deposit.

- The patriotic sentiment of investing and building in our country.

Disadvantage

- Long lock up period minimum 1 year, some are 2 years, and there are some more than 4 years.

- Minimum deposit of around $100.

How To Invest

Register investor identification with a bank, broker, or fintech company.

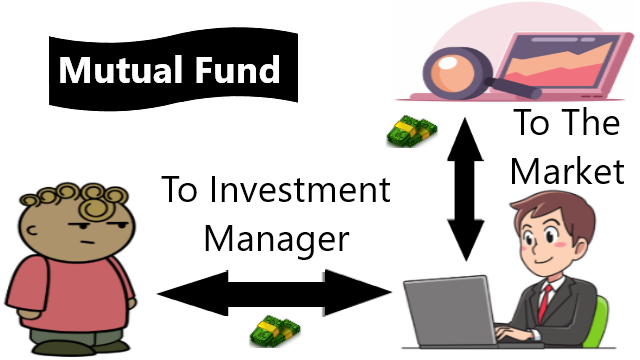

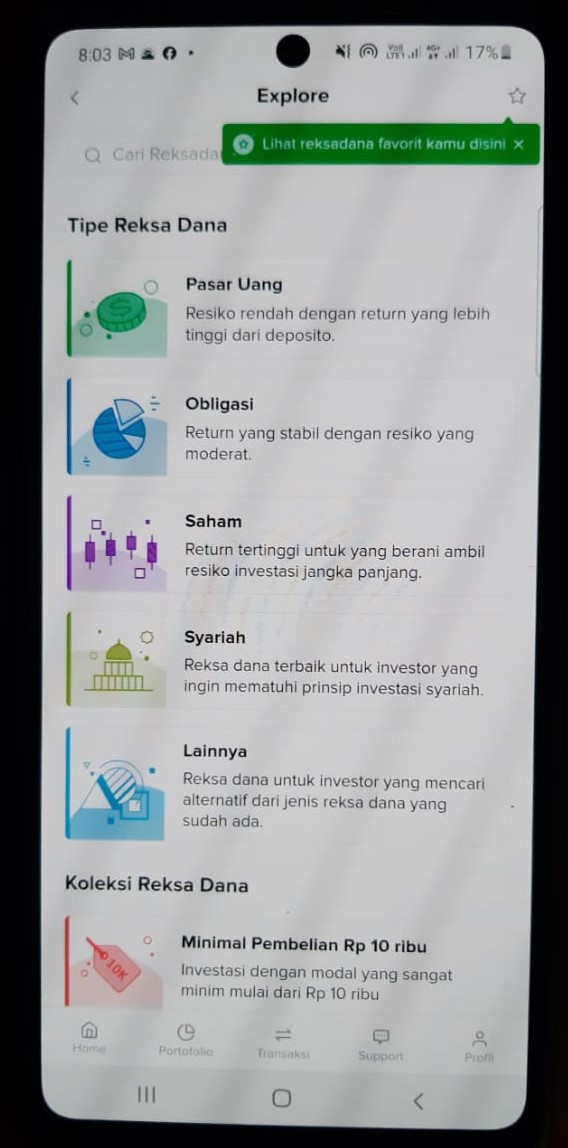

3. Mutual Funds

Short Description

Usually the same where we should go to the banks but with financial technology (fintech), there are many mutual fund applications online. The first time I learned of this is when an online shopping application I used opened their own mutual fund services. A mutual fund have the words “mutual” and “fund” which here means that an investment management handles the people’s fund to make profit. In other words, instead thinking hard ourselves of how and where to invest our money, we let these investment management considered to be experts handle the investment for us where ofcourse they get shares of the profit. There are investment managers or mutual funds whom invest with:

- Low Risk: usually only invest in money market funds which includes short-term borrowing and lending.

- Medium Risk: usually fixed-income such as government bonds, corporate bonds, or other debt instruments, kinda like the long-term of the money market funds where there are risks such as subject to changing interest rate and debts that cannot be paid due to bankcrupcy.

- High Risk: the equity market such as the commodity and stock market.

Advantage

- No lock up for most mutual funds where we can request withdrawal any time but usually processed in working days and working hours. Some mutual funds have lock ups where I saw the longest was 1 month.

- Low minimum investment ranging from at least $1 - $100. Unlike certificate of deposit which is $1000 minimum.

- Most mutual funds offered higher interest than certificate of deposit. Those with same and lower interest still advantages as they are risk free and can withdraw anytime.

Disadvantage

- None other than the fees and shares we pay to the investment management.

How To Invest

Bibit and input 0fajarpurnama0. Alternatives:

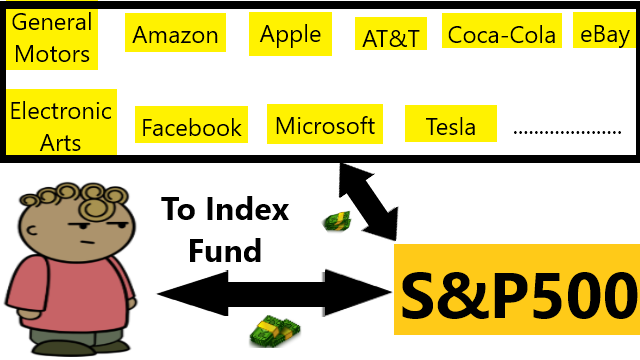

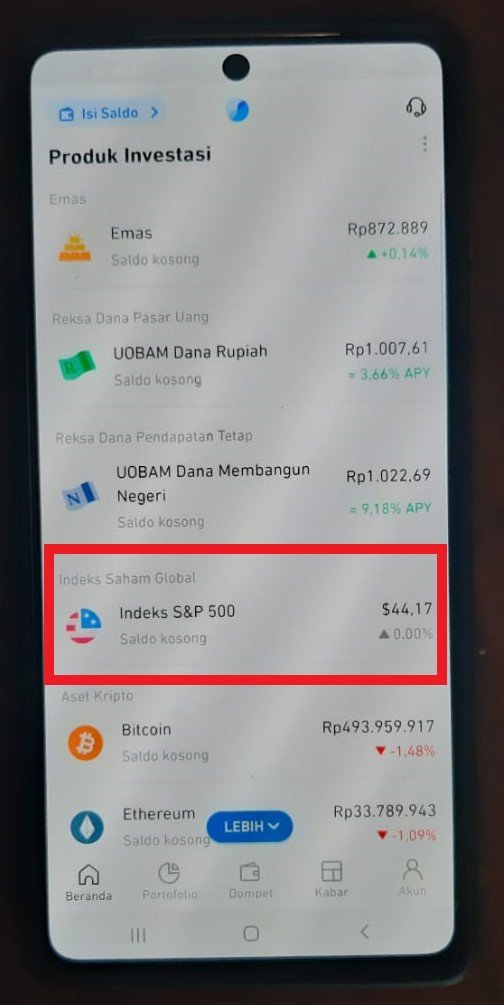

4. Index Funds

Short Description

Instead of investing in specific assets, through index fund we can invest in a group of assets. For example during the COVID-19 pandemic, we know that the health sector will appreciate. Instead of buying a specific stock or asset which does guarantee to appreciate along with the rest of the sector, we inject our funds in index funds instead. The index fund will then distribute the money to the rest in the sector for example in this case the health sector.

Advantage

- Just like mutual funds.

Disadvantage

- Currently rarely offered by providers.

How To Invest

Pluang and input FAJA794528.

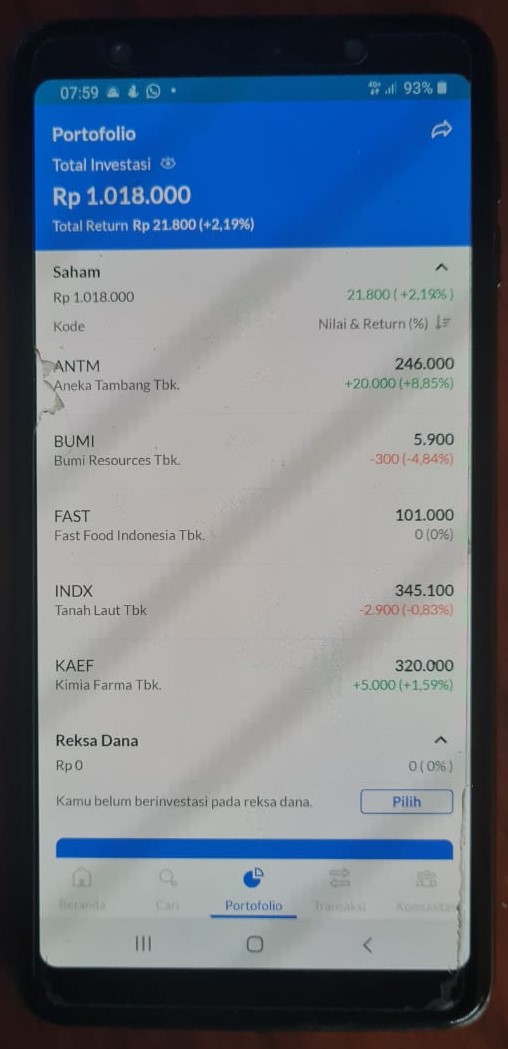

5. Local Stocks

Short Description

A Stock is really just a piece of a company but still many people still cannot understand. The real question is, what does owning a piece of a company means? What I know is that we definitely have voting rights in the company’s direction since we owned some it. Many companies gives dividends which I think is a share of their profits. Check with each company of what kind of exclusive things we get. A stock price increases because just people wants to buy it and that is it. Other than to gain somw rights in the company, people just want to own good things. Many times, it does not have to be truly good, but just good in the surface is enough where people buy stocks just because people talks about them meaning they are popular.

Advantage

- High returns, while previous investments are more like savings, in stocks we really can get rich.

Disadvantage

- Minimum shares purchase where some 100, some 1000, and some are more. For example, if a stock share worth $1 and the minimum purchase is 100 then the minimum amount of purchase is $100. Usually, the prices in applications are already in lots where 1 lot can be 100 shares, 1000 shares, depending on the country.

- High risks, like we can get rich in stocks, we can also lose almost everything.

How To Invest

Ajaib and input faja6242098696.

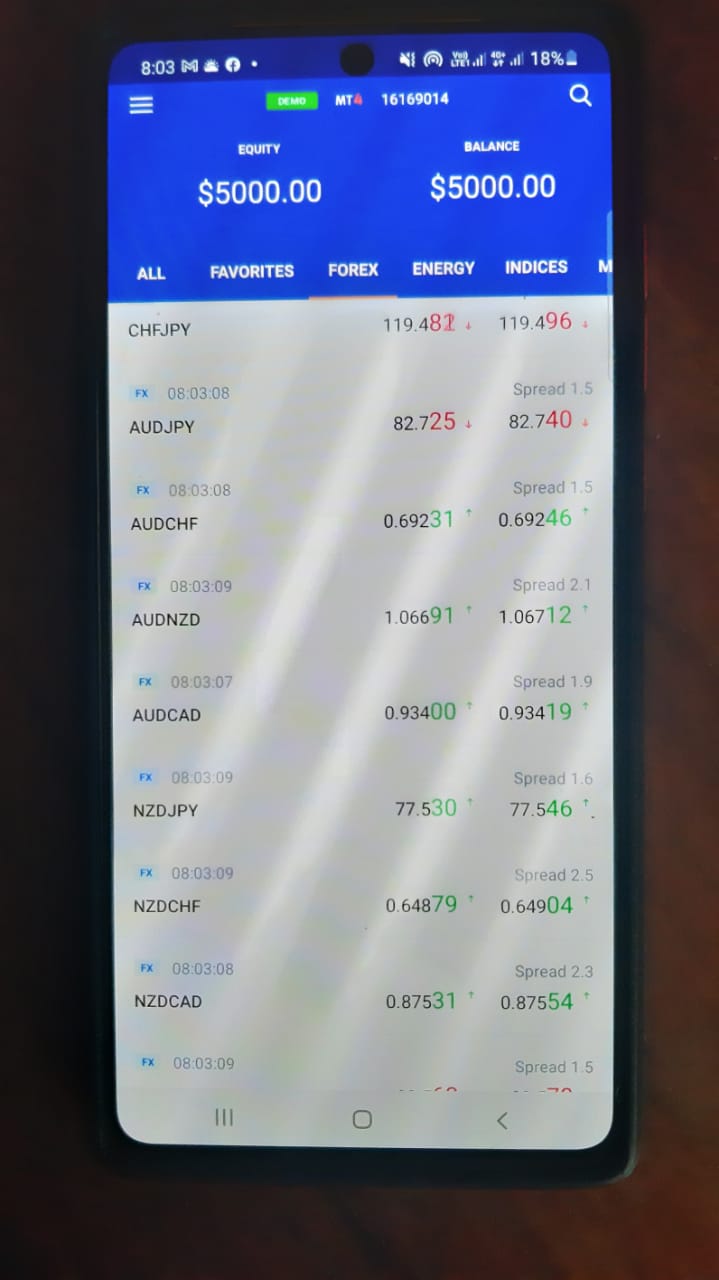

6. International Stocks and Commodities and Foreign Exchange

Short Description

Usually all adult citizens can trade and/or invest in their country’s stock market. However, there are stocks in other countries that may provide better opportunities. The United State (US) stocks is the most popular such as Apple, Microsoft, Tesla, Coca Cola, etc where almost all traders in the world wants to trade in. The problem is how to enter those market for example we need a US citizenship card and pay 40% taxes to purchase their shares. For commodities in reality is really be a merchant like buying and selling oils, gas, wheats, etc, same as foreign exchange where we go to money changers to buy foreign currencies, but we see many people trading them online. The only official way I know now is through contract trading. Sometimes it is called derivative or future trading. We press “long” if we think the asset will go up and press “short” if we think the asset will go down. If we are right, we profit but if we are wrong, we get liquidated because we really do not own the asset we purchase but more like betting whether it will go up and down. Additionally, there are leverage options where we can multiply our profits but also our losses.

Advantage

- Potential Higher returns than local stocks.

Disadvantage

- Difficult to enter.

How To Invest

Octa Investama and input if218668.

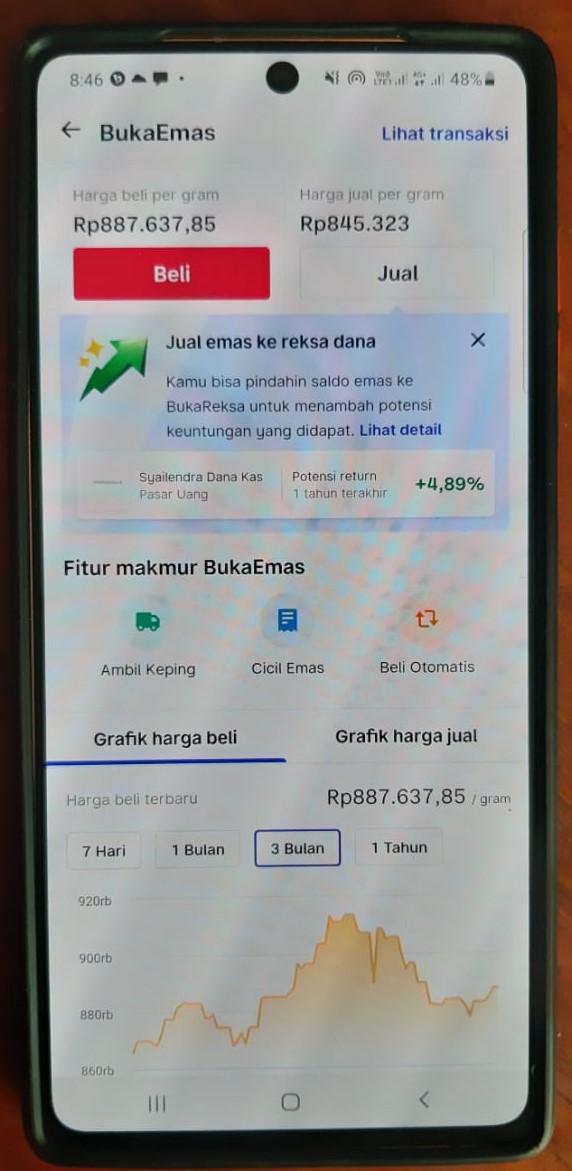

7. Gold & Silver & Other Precious Metals

Short Description

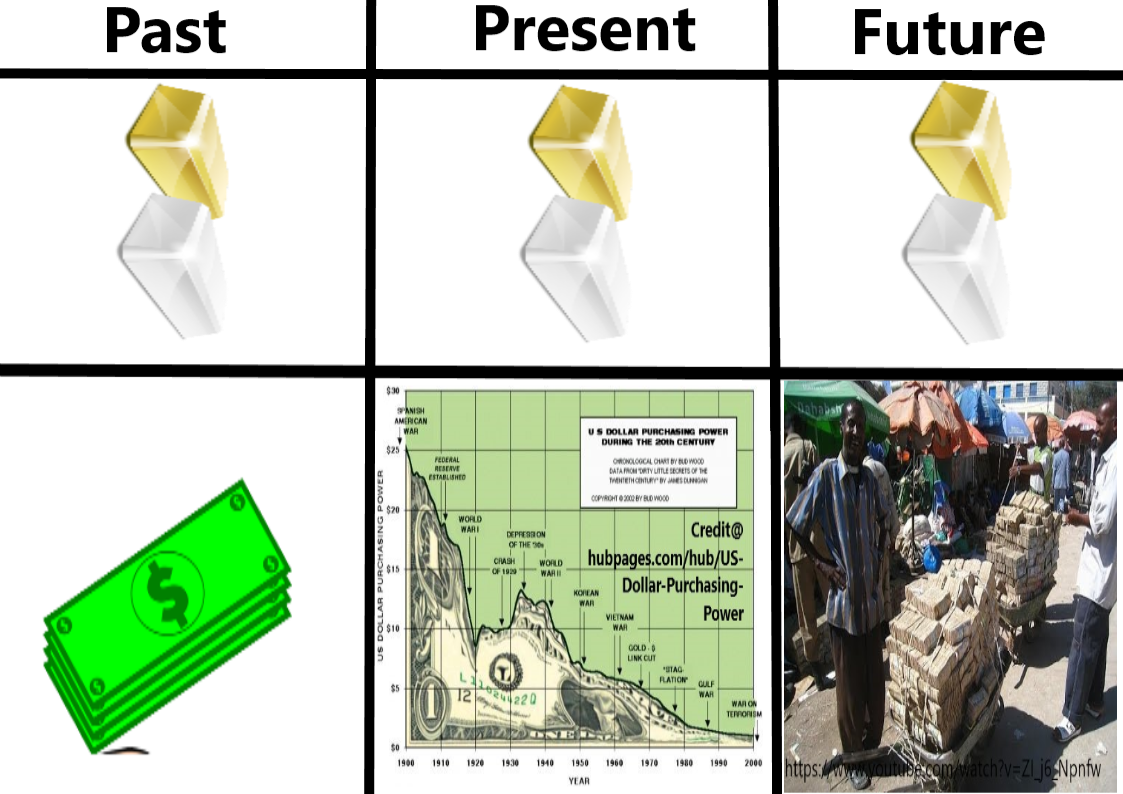

Gold is the one of the oldest form of money that survived for many centuries. The previous investments other than stocks and commodities are inside the central banking system of the country. The currencies that are fiat meaning backed by the government such as the Dollar, Euro, Pound, Yen, Yuan, can also collapse. Example countries where the currency collapsed are Zimbabwe, Venezuela, and Lebanon. Their currencies during the collapse are worth almost nothing where really just a piece of paper or metals. For example, in Venezuela before collapse, we can buy a bread with a paper of their currency, when it collapses we need thousands of those paper currencies to just buy a single bread. Simply the people holding the cash who were able to afford anything now cannot afford anything because nobody wants their cash now. When the value collapses, a piece of paper is just a piece of paper that can be ripped, can get wet, can be burned, very few uses, etc.

In the past where finacial collapse happened in Athena and Rome, only gold, silver, and precious metal survives. The properties such as the color, the shine, the conductivity, the strenght, etc of this precious metal does not change no matter how many years passes. Simply, it does not deteriorate which is why many people uses the metals as a store of value. People buy gold and silver not to get rich but to protect their wealth where those who are rich buys gold to stay rich.

Advantage

- Wealth preservation proven through history.

Disadvantage

- Physically too heavy to carry and more difficult to safe guard from thieves and plunderers.

- Digitally, can they really be trusted?

How To Invest

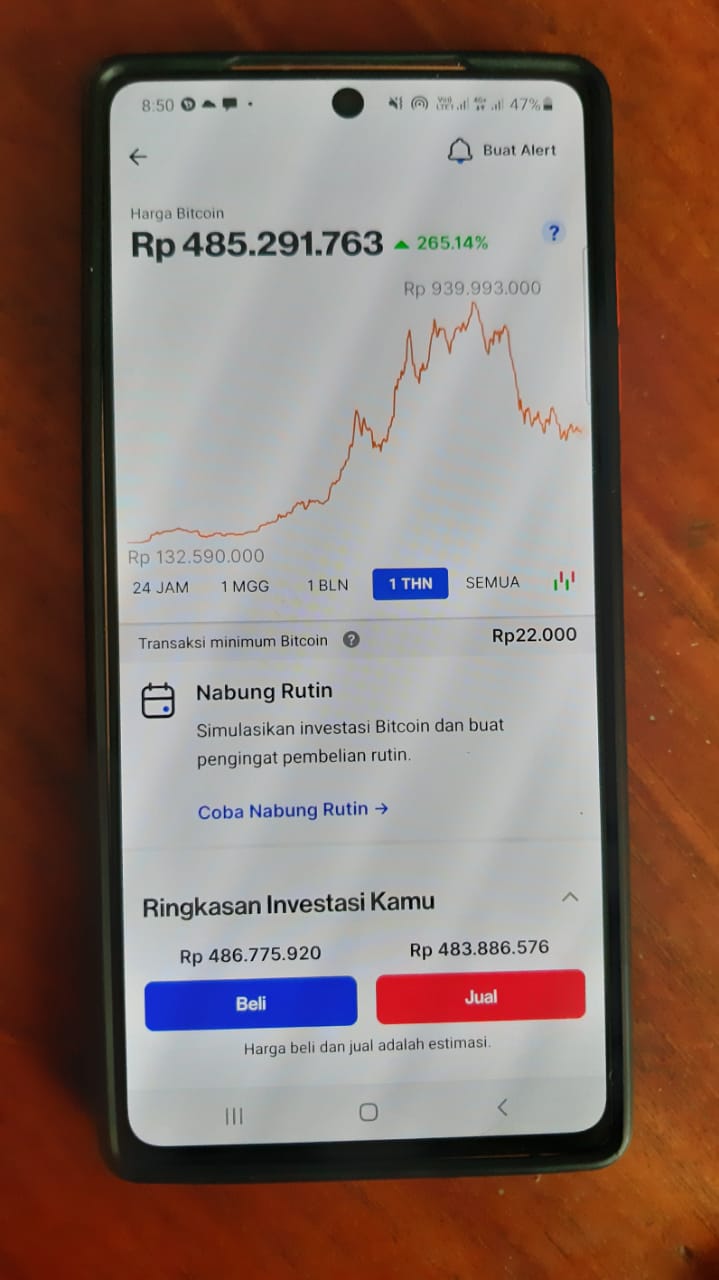

8. Cryptocurrency

Short Description

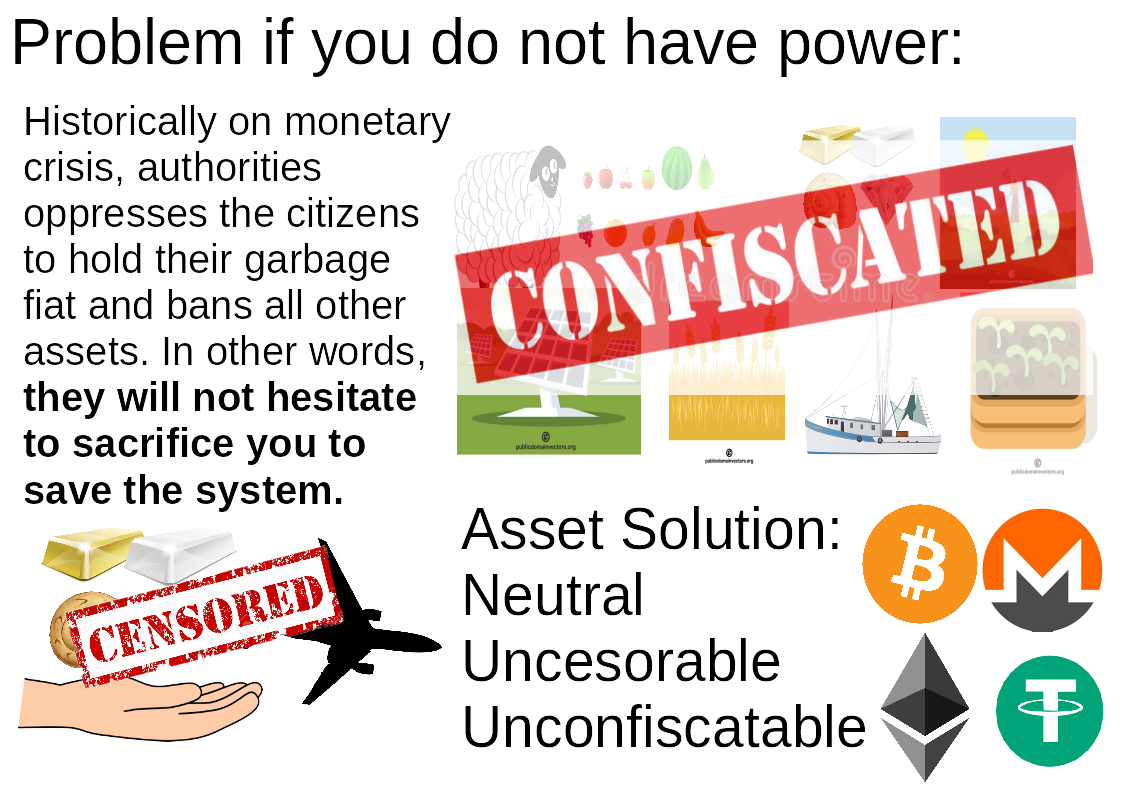

Is a currency powered by cryptographic technology where they called it the block chain technology being able to preserve history unlike many histories that have been manipulated. The open cryptocurrency versions combines blockchain with distributed system achieving decentralization. It is a dream for many people to have access to a currency that is not controlled by any entity, does not need intermediaries to function in consensus, therefore free from politics. The program lacks the cleverness of people which is what we need. Unlike people even in authorities, it does not know how to lie, to deceive, to corrupt, and to oppress. Cryptocurrency only works solely on the agreement. The difference between traditional banks and decentralized banks are that although the law and regulation forbids taking clients’ money from their bank accounts, the providers and authorities still have the ability to do so just liked what happened in Argentina and India, while decentralized banks does not even grant the ability to do so even to the owners and creators.

The reason why cryptocurrency is attractive is that the fixed supply and those that are not fixed are the agreed level of inflation or deflation. For example, there will be no more than 21 Million Bitcoin in existence meaning that only 21 Million maximum can own 1 BTC. Other than the convenience of its digital nature (easy to transfer between anywhere in the world), people are attracted to Bitcoin because they are immune to censorship and cannot be confiscated and thus giving full ownership notion to its holders. Other cryptocurrencies gives additional features such as some gives privacy, some gives access to investments that we normally cannot access such as foreign stocks and commodities, banking services such as lending, borrowing, and earning interest, and subscription services to a product. Aside from that, the extreme rising price of cryptocurrency is because of the borderless and open nature that anyone anywhere regarding of age, background, and motive can enter, highly speculating that this technology will be the future.

Advantage

- Open and borderless to anyone anywhere in the world and to many other investment opportunities. Note that centralized exchanges are different which is just like money exchanges. However, unlike a whole month waiting to be verified in government bonds, maximum whole week to be verified in mutual funds, and the complicated requirements of opening a stock account, registering to a cryptocurrency exchange is the easiest and the fastest among them.

- Cannot be censored and confiscated giving full ownership.

- Determined and transparent supply.

- The highest profit among all other investment products and additionally we are still early at the time of this writing.

Disadvantage

- Double edge sword of cannot be confiscated that if we are clumsy and lose our keys to our accounts will be locked forever that nobody can open.

- Double edge sword of censorship resistant that if we are clumsy and transfer to a wrong address cannot be reversed.

- The higest profit but also the highest risk where there many who became new millionaires, there are also many who lost all their investment and become poor. Also a double edge of open to everyone that anyone can freely speculate.

How To Invest