The Crops Utilities a Homework for DeFi Farming

If even famous crypto Youtubers said “what is this yield farming craziness? it is just putting your tokens and get a new token with fancy food names, the only reason they have value is because people speculates into them and when it ends then it will go back down”, then what would regular people who even still doubts the future of Bitcoin thinks? This is a homework for everyone in DeFi farming if we want crops with sustainable value in the future. For those of you who are new to DeFi or yield farming, let us return to few prerequisite information before diving into the discussion.

Does The Current DeFi Guarantees Full Ownership?

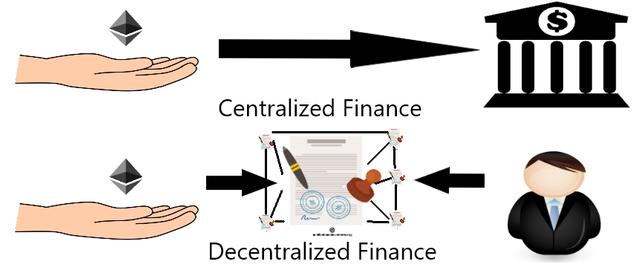

The answer is does not but may still guarantees more than Centralized Finance and/or Custodians. The difference between centralized finance and decentralized finance is to whom we trust our assets to. In traditional centralized finance, we trust them to a single party where we let them hold our assets and the reason trust is important because they are able to do anything with our assets including stealing them. In the current decentralized finance, we trust our assets to a smart contract which contains a series of codes that executes the agreement automatically where nobody nor the creator of the contract nor the recepient can violate which is why many believed to be non-custodial because nobody is holding the asset. However, there is something that is holding the asset and that is the smart contract and it is here that we must understand that it is not as ideally safe as we thought. A smart contract can be malicious, can be buggy, can be exploitable, which is why to truly be guaranteed is to read the smart contract thoroughly ourselves. Ofcourse, this is too much work for most of us so the looser option is to trust an audit by third parties, see if many people are using it and long time had passed without accidents, or just do not put much. A last piece of information about DeFi is the decentralization where the smart contract is on the blockchain distributed and agreed by everyone with high censorship resistance.

What is Yield Farming

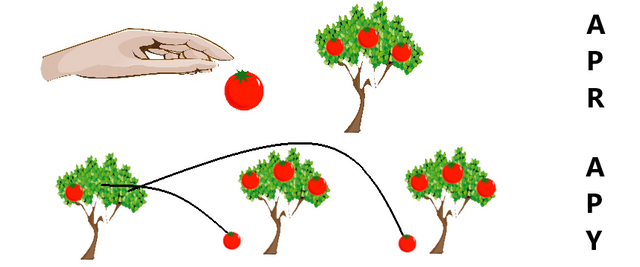

First we need to understand the difference between annual percentage rate (APR) and annual percentage yield (APY). APR is the interest we get for depositing an asset while APY includes the interest earned when depositing the interest from APR as well. In farming, try planting a tomato. The amount of tomato that grew is the APR. Now picked all the grew tomatoes and plant them as well. All the tomatoes that grew now is the APY.

We can do more complicated stuff like crossbreeding many kinds of tomatoes and obtained a new kind of tomato. That crossbreed that tomato to another tomato to get another new kind. Serious farming is not that simple. There many steps that needs to be done to get certain fruits, crops, or breeds, for example a water melons and grapes without seeds, hotter or less hotters chillies, smaller or larger apples, or even sweeter or less sweeter fruits. To do serious farming other than the seeds and water, you need a land, appropriate soils, fertilizers, chemicals, and other tools and materials. You know what? DeFi yield farming can be more complicated than that to note if you want high returns. Here’s an example of participating into a Phoenix Fund in Statera that I personally attempted:

- If you have Ethereum, you can just transfer them to a web3 wallet. If not, then start from the beginning in how to obtain Ethereum and learn how to use decentralized exchange and DEFI.

- Go to their website, and click the trade menu to get some Statera (STA), also get wETH. (gas fee occurs)

- Go back to their website, scroll down, click the button stating providing liquidity for Statera (STA) in uniswap, and provide liquidity by locking equal amount of Statera (STA). (gas fee occurs)

- To see the delta token contract address, just paste your wallet address in any Ethereum explorer.

- Go back to their website, scroll down, click the button stating providing liquidity phoenix fund on Balancer.

- Connect wallet, click provide liquidity, create proxy, and activate necessary assets. (high first time gas fee occurs)

- Choose either single asset or all pool assets to deposit the delta token. (very high gas fee!)

- If you choose all pool assets, you also need wBTC, SNX, and LINK

- Finally you will get a Phoenix Fund token which can potentially give you returns. (another gas fees for harvesting?)

If you think that process is complicated, then know that is actually still categorized as a very easy strategy. High yield DeFi farming can be more complicated. With the current gas fee system and demand, many people claimed that DeFi farming will only profitable when investing above $1000. Below that is not recommended except for just wanting to try. Before proceeding to the next section, here are todays famous farming platforms based on https://academy.binance.com/en/articles/what-is-yield-farming-in-decentralized-finance-defi:

Compound Finance

Customers needs to borrow tokens, Compound Finance requires suppliers and that could be us, we lend liquidity and Compound Finance rewards us in COMP tokens. Today, compound is one of the core protocol of yield farming ecosystem.

MakerDAO

We lock assets as collateral to maintain the DAI token stable to one dollar.

Synthetix

Similar to MakerDAO, we lock assets as collateral to issue tokens of anything that has price feed for example commodities, equities, and forex.

Aave

Another lending and borrowing protocol but famous for its flash loans. Lenders get “aTokens” in return for their funds.

Uniswap

The most popular decentralized exchange (DEX) today using automated market maker (AAM). Supplier provides liquidity by locking their assets for customers to exchange tokens. Other than receiving commissions, suppliers receives UNI tokens

Curve Finance

Curve Finance is a decentralized exchange protocol specifically designed for efficient stablecoin swaps.

Balancer

Like Uniswap liquidity provider but allows custom allocations while Uniswap allocations are only 50/50 for each exchange pair. Suppliers receives BAL token.

Yearn Finance

Yearn.finance is a decentralized ecosystem of aggregators for lending services such as Aave, Compound, and others. It aims to optimize token lending by algorithmically finding the most profitable lending services.

Enter Harvest Finance

Chad is a serious farmer. He owned lands, many seeds, fertilizers, all the tools and materials needed, and studied many farming techniques out there. One day Chad meets a new form of farming. From https://redmption.medium.com/a-bountiful-harvest-awaits-373cbc9cb7d4, one of his experience is farming at Curve.fi where he deposit stable coins at Curve (gas), deposit the “yToken” into the Curve Dao (gas), wait X amount of time, harvest CRV (gas), sell CRV to stable coins(gas), then repeat step 1 for continuous compounding (gas, gas, gas…). Athough the process was complicated but Chad really enjoyed the process and found a new passion in DeFi farming. Over time, Chad’s friends began to notice his DeFi farming and wanted to join. However, some of his friends are not as passionate as him and only wanted to lend their seeds to Chad. Things are under control at first, but more and more people came and things began to get overwhelming for Chad.

The overwhelming demand squeezes Chad’s brain and an innovation squeezed out. Why not make machines to do the farming strategies for him and that is how harvest.finance is born. Harvest Finance provides the tools and materials for us and the bots that knows the highest yield farming strategies out there with the cheapest cost. All we need to do is throw our tokens to harvest.finance and let it farm for us. Did Chad forked it from Yearn Finance or other platforms? He admits that he made harvest.finance himself.

The Crops Utility

Clearly physical crops can be a necessity to our lives to fill our stomaches. Other than that, they can be processed to dishes, snacks, ingredients, lotions, medicines, drinks, coloring, clothings, and many other stuffs. Then what about DeFi crops?

- The most popular and easiest utility is as a governance token to have voting rights and determine the future of the platform.

- Sharing profit by buy backs and burns.

- Further yield farming.

I did not hear any other utilities, if any of you know more, please mention them in the comment section. However, I know other utilities for other crypto coins:

- Service discount as on most centralized exchanges.

- Digital product payments such as decentralized blog posting, file storage, video storage, and virtual private networks (VPN)s.

- Digital product subscriptions such as holding tokens for premium content access.

- Tokenized physical assets.

- Tokenized traditional investments.

- Gambling.

- Rewarding quality contents, activities, and other things.

- The default utilities which are value transfer, asset ownerships, and payments.

Leave a comment for not only other utilities you know but also future utilities ideas. This is the homework for yield providers.

As for Harvest Finance and other similiar platforms, the current strategy is to find the highest yield in price and/or quantity. There is an open room in developing strategies for determining other crop qualities. For example other than taking the utilities into account, a strategy can also be based on chain analysis such as number of holding address and amount of transactions, and another one is sentiment analysis. This way, we can also find undervalued crops. I am sure that most people preferred farming crops in increasing trend rather than crops in high volatility and/or decreasing trend. However, is it worth developing this feature now? I am not sure, because I am not sure with the crops utilities itself where the yield providers must provide value first but stashing this idea and take it into consideration in the future may proof advantageous.

Disclaimer: most of the images are modifications from Harvest Finance and https://publicdomainvectors.org.

Mirrors

- [#DeFiFARMer: (0) Connect wallet, (1) deposit stable coins, (2) deposit the “yToken” into the Curve Dao and wait X amount of time, (3) harvest CRV, (4) sell CRV to stable coins, then repeat.

@harvest_finance: Connect wallet and Deposit. More at #Publish0x

https://www.publish0x.com/0fajarpurnama0/the-crops-utilities-a-homework-for-defi-farming-xwnldrx?a=4oeEw0Yb0B&tid=github](https://www.publish0x.com/0fajarpurnama0/the-crops-utilities-a-homework-for-defi-farming-xwnldrx?a=4oeEw0Yb0B&tid=github)

- https://0darkking0.blogspot.com/2020/11/the-crops-utilities-homework-for-defi.html

- https://0fajarpurnama0.medium.com/the-crops-utilities-a-homework-for-defi-farming-3dafb44a25ba

- https://0fajarpurnama0.github.io/cryptocurrency/2020/11/13/crops-utility-defi-farming-homework

- https://hicc.cs.kumamoto-u.ac.jp/~fajar/cryptocurrency/crops-utility-defi-farming-homework

- https://steemit.com/defi/@fajar.purnama/the-crops-utilities-a-homework-for-defi-farming?r=fajar.purnama

- https://hive.blog/defi/@fajar.purnama/the-crops-utilities-a-homework-for-defi-farming?r=fajar.purnama

- https://blurt.world/defi/@fajar.purnama/the-crops-utilities-a-homework-for-defi-farming?r=fajar.purnama

- https://0fajarpurnama0.wixsite.com/0fajarpurnama0/post/the-crops-utilities-a-homework-for-defi-farming

- http://0fajarpurnama0.weebly.com/blog/the-crops-utilities-a-homework-for-defi-farming

- https://0fajarpurnama0.cloudaccess.host/index.php/11-cryptocurrency/99-the-crops-utilities-a-homework-for-defi-farming

- https://read.cash/@FajarPurnama/the-crops-utilities-a-homework-for-defi-farming-7256cb5a

- https://www.uptrennd.com/post-detail/the-crops-utilities-a-homework-for-defi-farming~ODA4NDkw

- https://www.torum.com/post/5faeb8d1baa83828e06bae70