Misconception of The Minimum 1 Lot and The Investing and Trading is Expensive

I have begun actively invite people to not only in cryptocurrency but other forms of trades and investments as well. My experience with Generation Z and my fellow Millenials is that they are eager to try. If they do not want to try, are either they do not have any money to spare or they are really not interested which are general reasons that can apply for anybody. However, my experience with older generations, baby boomers and above is that they have a misconception. True that there are people like Warren Buffet who does not believe in the future of cryptocurrency because they believe that it does not have underlying asset etc but this is not the misconception that I am talking about. There are few who believes in its future, and many who does not care but are open minded but they are scared to dive not only into cryptocurrency but all other forms of trades and investments as well.

The Misconception of Minimum Transaction

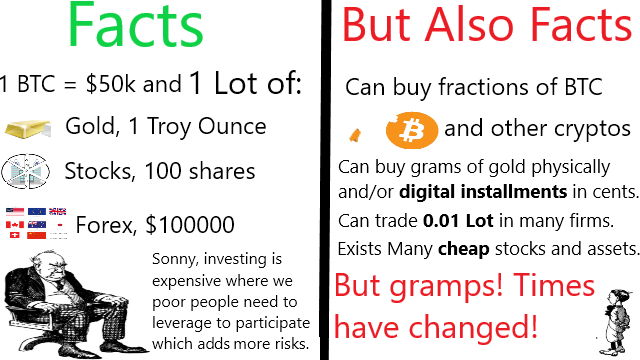

In the past, many brokers requires us to purchase a minimum of 1 Lot (securities trading), but what is 1 Lot?

- 1 whole Bitcoin is currently $50000.

- Bonds, 1 Lot = from $1000 to $5000.

- Foreign Exchange (Forex), 1 Lot = $100000.

- Stocks, 1 Lot = 100 shares

- Gold and Palladium, 1 Lot = 100 troy ounce.

- Silver, 1 Lot = 5000 troy ounce.

- Wheat, Corn and Soybeans, 1 Lot = 5000 bushels.

- Live cattle and lean hogs, 1 Lot = 40000 pounds.

- Crude Oil, 1 Lot = 1000 barrels.

- Heating oil and unleaded gasoline, 1 Lot = 42000 gallons.

If 1 Lot is really the minimum, then buying Apple stock requires a minimum of $14860 because the price is $148.6 per shares and 1 Lot = 100 shares = $148.6 * 100 = $14860. I was once approached by a salesman of a broker to invest in General Motors Company (GM) and I thought I only needed $50 but then they said the minimum is $5000 that made me very shocked. It turns out that their minimum investment is 1 Lot which is 100 shares. $5000 maybe small for developed countries but know this that in developing countries, the average salary is $250 a month which takes more than 2 years to get $5000.

The minimum amount to buy local stocks in my country is also 1 Lot which is 100 shares. However, stocks in Indonesia are not as expensive in United States (US) where one of the expensive stocks is Gudang Garam Tbk (GGRM), a cigarette company with a share of Rp 31975 ($2.23) and 1 Lot requires $2.23 * 100 = $223. The stocks that I bought in average costs Rp 50 per shares (¢0.35) where 1 Lot is only $3.5. The average Lots for Bonds is quite similar to certificate of deposit in my country where a minimum of $1000.

With the past knowledge above, older generations have a misconception of needing to buy a whole Bitcoin. The first time I showed the price to them, their immediate respond was “wow $50000, that is very expensive, I do not have $50000” followed by “my friends invests in stocks and lost their houses”. The past fears already prevented them from even getting to know cryptocurrencies and other trades and investments.

However, time changes, I tried trading forex and I can trade 0.01 Lot where still, $100000/100=$1000 is expensive but there are Options where I can just use $10 but of course risks liquidation if I trade wrongly. There are now mutual funds for anyone to start investing with only minimum of $1 and can request withdrawal anytime unlike certificate of deposits with months of locks.

True that investing in government bonds can lock our funds for more than a year but the minimum in my country have greatly decreased which is just $100.

Now for Bitcoin, we can buy as little as $10 where the fact is that we can buy a fraction of any cryptocurrency, but still, there are limitations caused by:

- Transaction and/or trading fees.

- Decimal settings in each cryptocurrency where if decimal is 1 than the minimum is 0.1 and note that most cryptocurrency have a decimal setting of 18.

- Some cryptocurrencies collect taxes.

- Maybe more factors that I do not yet know.

Trading gold not only we can buy physically but there are providers that allows us to buy digitally and in fractions as well where we can start as little as $1. The method is more like an installment where if our investment reaches 1 gram, we can claim the gold physically. Though option trading in forex applications are different where the minimum is 0.01 Lot for trading gold.

The Misconception of Minimum Deposit

Like the salesman who approached me requires minimum of 1 Lot which is $5000 to invest in general motors, brokers, trading, and investment firms back then probably requires a minimum deposit of not less than the amount for certificate of deposits which is $1000. $1000 in developing countries is a lot of money where to repeat again that the average salary is $250 a month which have not include living cost. Trading and investing are games of the rich during my childhood days.

However in this age, is different. The minimum deposit of modern firms are only limited by the business account bank transfer minimum amount which is Rp 50000 around $3.5 in my country. Today, just minimum of $3.5 not only in cryptocurrency exchanges but in many mutual funds and stock brokers as well. Other than minimum deposit, the next factor the limits the minimum amount of investment is the minimum amount of trade. The amount is different for each assets but in one my local exchange Tokocrypto, I found that the minimum to trade Bitcoin is Rp 20000 around $1.4. Therefore the minimum investment there is $3.5 because that is minimum amount to deposit.

Mirrors

- https://www.publish0x.com/cryptocurrency-101-for-users/misconception-of-the-minimum-1-lot-and-the-investing-and-tra-xglvyrj?a=4oeEw0Yb0B&tid=github

- https://0darkking0.blogspot.com/2021/08/misconception-of-minimum-1-lot-and.html

- https://0fajarpurnama0.medium.com/misconception-of-the-minimum-1-lot-and-the-investing-and-trading-is-expensive-f9795c50a86c

- https://0fajarpurnama0.github.io/cryptocurrency/2021/05/13/misconception-minimum-lot

- https://hicc.cs.kumamoto-u.ac.jp/~fajar/cryptocurrency/misconception-minimum-lot

- https://steemit.com/cryptocurrency/@fajar.purnama/misconception-of-the-minimum-1-lot-and-the-investing-and-trading-is-expensive?r=fajar.purnama

- https://leofinance.io/@fajar.purnama/misconception-of-the-minimum-1-lot-and-the-investing-and-trading-is-expensive?ref=fajar.purnama

- https://blurt.blog/cryptocurrency/@fajar.purnama/misconception-of-the-minimum-1-lot-and-the-investing-and-trading-is-expensive?referral=fajar.purnama

- https://0fajarpurnama0.wixsite.com/0fajarpurnama0/post/misconception-of-the-minimum-1-lot-and-the-investing-and-trading-is-expensive

- http://0fajarpurnama0.weebly.com/blog/misconception-of-the-minimum-1-lot-and-the-investing-and-trading-is-expensive

- https://0fajarpurnama0.cloudaccess.host/index.php/cryptocurrency/8-cryptocurrency-101-for-users/265-misconception-of-the-minimum-1-lot-and-the-investing-and-trading-is-expensive

- https://read.cash/@FajarPurnama/misconception-of-the-minimum-1-lot-and-the-investing-and-trading-is-expensive-16c1c2d6

- https://www.loop.markets/misconception-of-the-minimum-1-lot-and-the-investing-and-trading-is-expensive/

- https://markethive.com/0fajarpurnama0/blog/misconceptionoftheminimum1lotandtheinvestingandtradingisexpensive