Should We Farm? My Yield Farming Theoretical Calculation Opinion

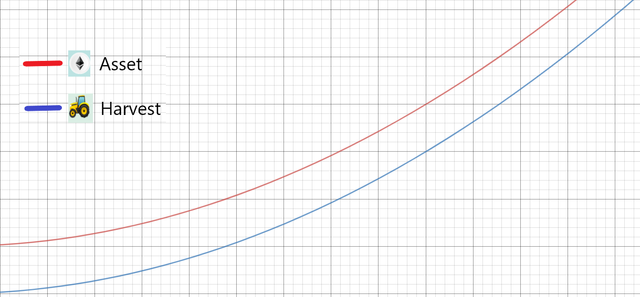

Other than the fees and the APY, it really depends on the future value both assets and harvests. To Farm, not farm, or just buy the harvest.

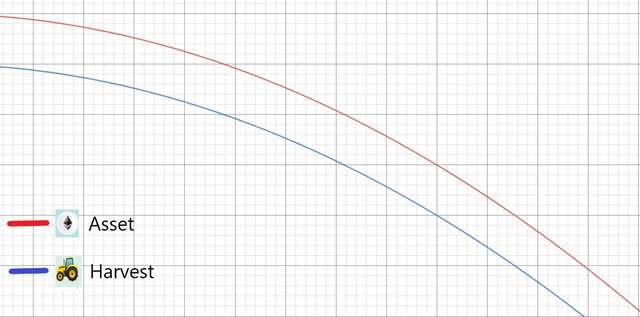

1. When To Sell Your Asset

When asset will go down and harvest will go down, sell everything unless the annual percentage yield (APY) can cover for the loss.

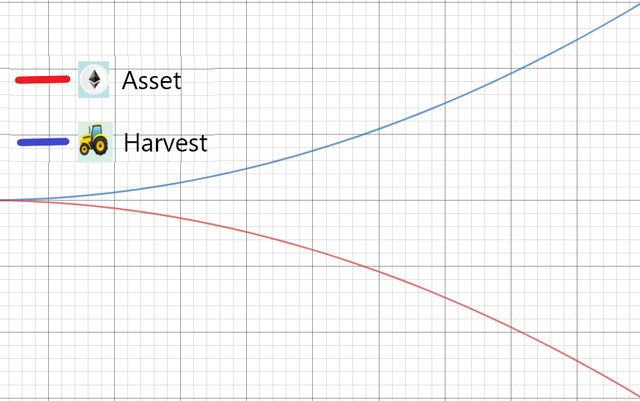

2. When Not to Farm but Buy Harvest

When asset will go down and harvest will go up, forget about farming and just buy the harvest. If you farm, you will get less and less harvest as the asset goes down.

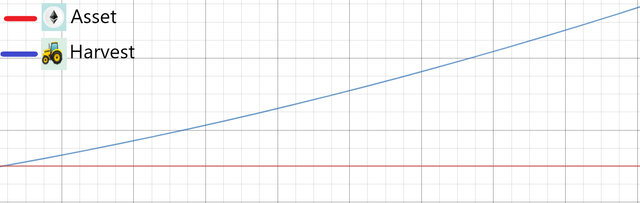

3. Farm or Buy Harvest Depends on Fees and APYs

When asset will stay still and harvest will go up depends on the fees and APYs. If farming costs low fee and produces high yield then farm, otherwise just buy the harvest as you may not get much harvest and/or you need to pay the fee.

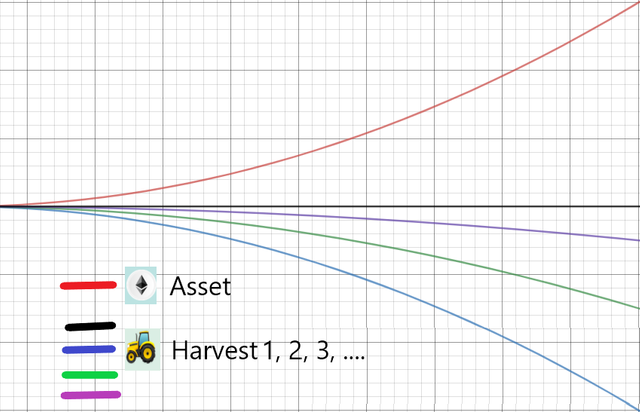

4. When Farming With Highest Yield Strategy

When asset will go up and harvest does not follow whether it will go down, stay still, or does not go up much, then farm using the strategy with the highest yield. If you do not understand what yield is, it is to use the harvest to farm for another harvest either by farming another different type of harvest, sell the harvest to asset to farm more harvest again, or some complicated combination where Harvest Finance provides that strategy for you.

5. When to Farm and Any Strategies Works

When asset will go up and harvest will also go up, I think any farming will do. Though the best is to use the harvest to farm another harvest but selling the harvest to farm the same harvest may not change anything. Sure you can farm more of the same harvest but do not forget that you sell the harvest low and it is going up in value.

How To Farm?

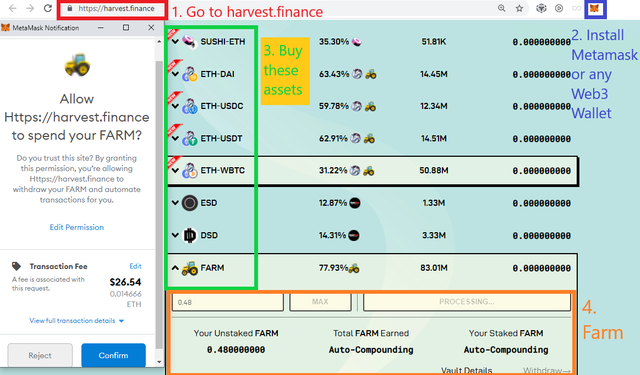

- Go to https://harvest.finance/.

- Install Metamask or similar web3 wallet.

- Buy assets and after that, click “connect wallet”.

- Allocate asset amount and click stake.

Do I Farm?

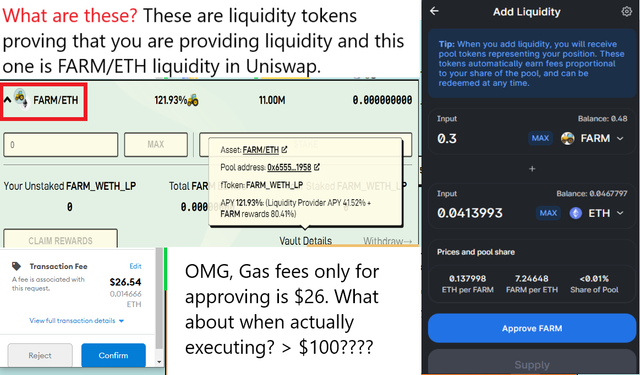

What are those pairs? Those pairs are liquidity tokens where you will get after providing liquidity on a certain decentralized exchange (DEX) platform. Do I farm, no, I’m not a whale where the gas fee is killing me.

- Approve spending to buy assets … gas fee.

- Buy assets … gas fee.

- Approving farming … gas fee.

- Farm … gas fee.

- Withdraw harvest … gas fee.

- Unfarm … gas fee.

- And more … gas fee.

If there are no fees I would have farmed using the fiat stable coins asset strategy (USDC, USDT, DAI, …) because crypto is not in the phase of wide adoption yet and therefore a crash may come far in the future and I will farm and wait until that time to buy discounted assets using my fiat stable coins.

Mirrors

- https://www.publish0x.com/0fajarpurnama0/should-we-farm-my-yield-farming-theoretical-calculation-opin-xdnqjkq?a=4oeEw0Yb0B&tid=github

- https://0darkking0.blogspot.com/2021/02/should-we-farm-my-yield-farming.html

- https://0fajarpurnama0.medium.com/should-we-farm-my-yield-farming-theoretical-calculation-opinion-d81e11b7085f

- https://0fajarpurnama0.github.io/cryptocurrency/2021/02/09/yield-farming-theoretical-calculation-opinion

- https://hicc.cs.kumamoto-u.ac.jp/~fajar/cryptocurrency/yield-farming-theoretical-calculation-opinion

- https://steemit.com/cryptocurrency/@fajar.purnama/should-we-farm-my-yield-farming-theoretical-calculation-opinion?r=fajar.purnama

- https://leofinance.io/@fajar.purnama/should-we-farm-my-yield-farming-theoretical-calculation-opinion?ref=fajar.purnama

- https://blurtter.com/cryptocurrency/@fajar.purnama/should-we-farm-my-yield-farming-theoretical-calculation-opinion?referral=fajar.purnama

- https://0fajarpurnama0.wixsite.com/0fajarpurnama0/post/should-we-farm-my-yield-farming-theoretical-calculation-opinion

- http://0fajarpurnama0.weebly.com/blog/should-we-farm-my-yield-farming-theoretical-calculation-opinion

- https://0fajarpurnama0.cloudaccess.host/index.php/11-cryptocurrency/204-should-we-farm-my-yield-farming-theoretical-calculation-opinion

- https://read.cash/@FajarPurnama/should-we-farm-my-yield-farming-theoretical-calculation-opinion-5a38e5ca

- https://www.uptrennd.com/post-detail/should-we-farm-my-yield-farming-theoretical-calculation-opinion~ODYyMDIx